how to claim iloe insurance is a straightforward process designed to provide ease and efficiency to policyholders. in this article we will offers how to claim iloe insurance and iloe insurance uae eligibility, cost and payment.

Table of Contents

how to claim iloe insurance online

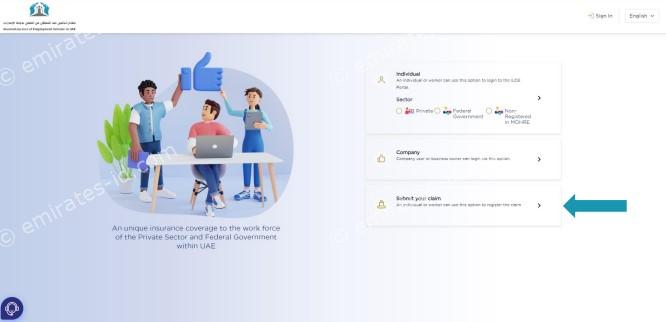

To initiate a claim with ILOE Insurance, follow these steps:

- Visit the ILOE portal and select “Submit Your Claim.”

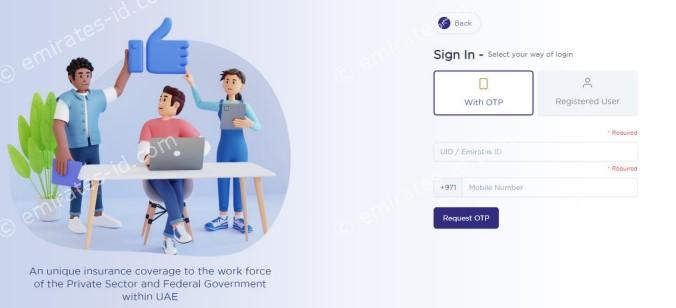

- Enter your Emirates ID and mobile number starting with “5x-xxxxxxx.”

- Sign in using a One-Time Password (OTP) sent to your mobile number.

- Click on “Claim Submission” to begin the process.

- Proceed to your claim process by clicking “Proceed.”

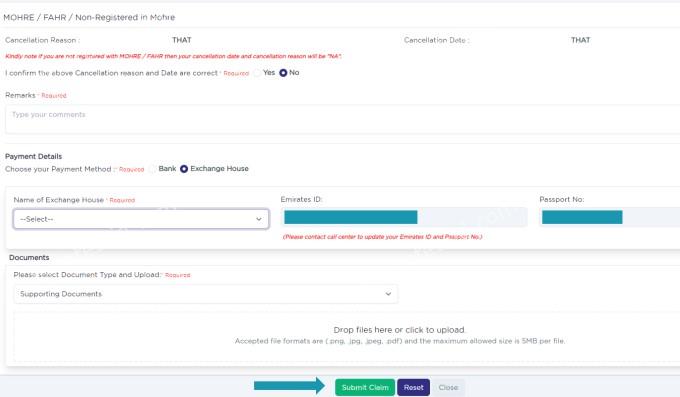

- Confirm the reason for cancellation and specify the date.

- Provide any necessary notes and supporting documents.

- Choose “Bank Transfer” as the payment method for reimbursement.

- Select “Exchange House” as the payment method if preferred, ensuring you have a valid Emirates ID to collect payment.

- Click “Submit Claim” to complete the process.

read more: how to check insurance in emirates id

how to claim iloe insurance for employment

The primary objective of the iloe insurance Scheme is to offer a level of protection to individuals working in the private sector and federal government sectors. It does so by providing compensation for a limited period, not exceeding 3 months per claim, in the event of job termination. This initiative is designed to ensure that affected individuals can maintain a respectable standard of living within the United Arab Emirates.

iloe insurance uae eligibility

The eligibility criteria for ILOE Insurance include Emiratis and residents working in both the federal government and private sectors.

iloe insurer in uae

The insurers participating in the Insurance Pool, managed by Dubai Insurance Co. psc, include:

◼ Abu Dhabi National Takaful Insurance Company.

◼Abu Dhabi National Insurance Company.

◼Al Ain Ahlia Insurance Company.

◼Emirates Insurance Company.

◼National General Insurance Company.

◼Orient Insurance Company.

◼Orient Takaful Insurance Company.

◼Oman Insurance Company.

read more: how to get emirates id copy online

iloe insurance cost

Here are the costs associated with ILOE Insurance:

✅ Category A

| Eligibility | Basic salary ≤ AED 16,000 |

| Monthly Benefit | 60% of average basic salary over the last 6 months before job loss |

| Maximum Benefit | Up to AED 10,000 per month for 3 consecutive months |

| Premium | AED 5.25 per month |

| Duration | 12 months |

✅ Category B

| Eligibility | Basic salary > AED 16,000 |

| Monthly Benefit | 60% of average basic salary over the last 6 months before job loss |

| Maximum Benefit | Up to AED 20,000 per month for 3 consecutive months |

| Premium | AED 10.50 per month |

| Duration | 12 months |

iloe insurance payment

The UAE Government offers various convenient methods to enroll in the Insurance iloe Scheme:

ILOE Portal: Visit iloe.ae

Official ILOE App

Exchange Centers.

Tawjeeh & Tasheel Business Centers.

Payment through Telecom Service Bills.

SMS Payments.

Selected Payment Kiosks & Apps.

iloe insurance contact number

If you have any inquiries or require assistance regarding ILOE Insurance, you can easily reach out to them by dialling their contact number at 600 599 555.

iloe insurance UAE app

You can download the ILOE Insurance UAE app from the following links:

- For Android devices: ILOE Insurance UAE app on Google Play.

- For iOS devices: ILOE Insurance UAE app on the App Store.

iloe insurance website

You can visit the ILOE Insurance website at the following link: ikoe Insurance directly.

how to claim iloe insurance underscores a user-friendly approach tailored to simplify the claims procedure for policyholders.

How can I get ILOE certificate online?

Log in to ILOE portal www.iloe.ae or ILOE Mobile APP.

Choose your Sector.

Add your Emirates ID and Mobile number and Request OTP.

Who is eligible for ILOE?

All UAE Nationals and residents employed in both the private and government sectors are mandated to enroll in the scheme, with the exception of individuals falling within certain categories. These exceptions include investors or owners of the companies where they are employed, domestic helpers, and temporary-contract workers.

Leave a Comment